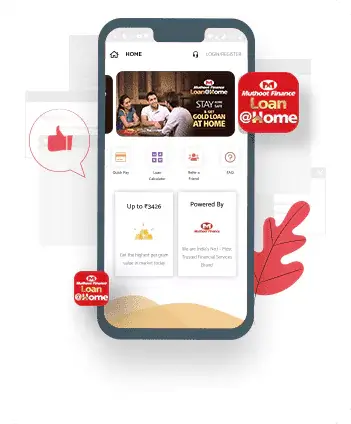

Muthoot Finance has been a pioneer in the gold loan segment for decades. Now, we add another strategic service to our gold loan portfolio – the Gold Loan@Home service that lets you to avail gold loan at the comfort of your home in just 30 minutes!

The Gold Loan@Home is an instant gold loan service where all you have to do is give us a call to put in your request for a gold loan. Our executive from the nearest branch will then visit your home at the earliest.

Right from the evaluation of your gold, documentation to the transfer of the loan amount, everything is done at your home in your presence.

With the ‘Gold Loan@Home’ service, our customers get numerous benefits like lower interest rates, flexible repay tenures, easy payment options, no additional charges, and 24*7 customer support, to name a few. Along with all this, we also offer a wide range of gold loan schemes to cater to the diverse requirements of our customer base. At Muthoot Finance, we respect the privacy of our customers and make sure that their details are not disclosed to any third party whatsoever. At the same time, we assure the full security of the loan borrower´s gold while in transit and the locker.