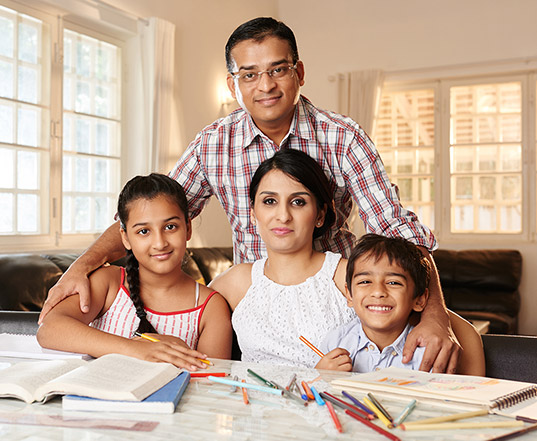

If you need some funds urgently, then applying for a gold loan is the best option. You can use the money to do many things, such as pay outstanding debts, pursue further education, or wedding. At Muthoot Finance, we understand the needs of our customers. We offer gold loans with lower interest rates for all our customers. The best part is that you need very little documentation to apply for a gold loan. Also, the Muthoot Finance gold loan takes very little time to process. It is the best solution to take care of your financial needs when in need of some money in a short span of time.

We offer our customers multiple online payment options to pay off the gold loan amount. You can also request changes in your loan tenure to make it easier.

Apart from this, customers also have the option to pay the interest upfront or after paying the principal loan amount. Additionally, customers can also request a change in the repayment tenure of their gold loan.

Muthoot Finance offers the best gold loans at low-interest rates. You can choose from various options when applying for a gold loan. At Muthoot Gold Loan at Home, you can find the most suitable option that suits your unique needs. We ensure you have a hassle-free experience when availing a gold loan online from the comfort of your home.

We understand the importance of your valuable gold. This is why we provide a specialized safe room with CCTV cameras to ensure the safety of your gold items.

At Muthoot Finance, our customers are our number one priority. We make sure that they don't face any inconvenience when paying their loan amount. Customers can make a partial payment to pay their gold loan via Muthoot Finance Quick Pay portal where one needs to select the type of loan, and fill in basic loan details like loan type, loan number, branch code, customer ID, and mobile number to process the payment.

Further, customers can use other options like the Gold Loan@Home mobile application by Muthoot to pay off their gold loan amount. Customers can pay part of their loan amount along with the gold loan interest payment in case of a partial payment. Gold Loan@Home mobile application can be used to make payments online without visiting the branch. Customers can also use the mobile application to keep track of their payments and loan tenure.